BTC Price Prediction: Retest of $111K Support Likely Before Next Bullish Phase

#BTC

- Technical Outlook: BTC tests lower Bollinger Band with MACD suggesting impending bullish crossover

- Market Drivers: Institutional accumulation (Metaplanet) offsets derivative market liquidations

- Key Levels: $111K support critical for maintaining bullish macro structure

BTC Price Prediction

BTC Technical Analysis: Short-Term Bearish Pressure Amid Accumulation Signals

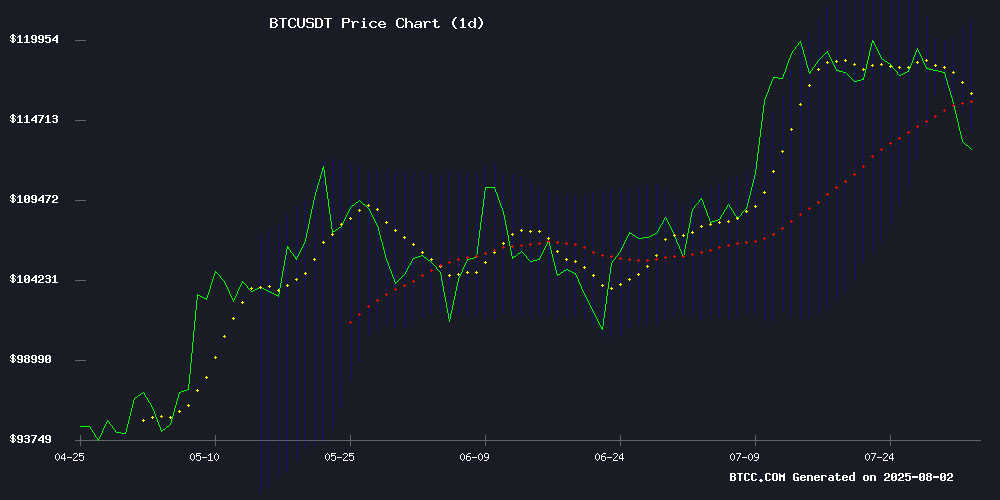

BTC currently trades at $113,906, below its 20-day moving average ($117,732), indicating near-term bearish momentum. The MACD histogram (2006.8) shows bullish divergence despite negative signal lines, while Bollinger Bands suggest consolidation between $121,058 (upper) and $114,406 (lower). 'This pullback resembles healthy profit-taking,' says BTCC's Ava, noting 'the $111K support level could trigger renewed institutional demand.'

Market Sentiment: Long-Term Holders Buy the Dip Amid Macro Uncertainty

While Leveraged liquidations and dormant wallet movements create short-term volatility, Metaplanet's $3.7B BTC acquisition plan and IMF's recognition signal structural adoption. 'Geopolitical tensions are masking fundamental strength,' observes Ava, adding 'the $115K-$111K range represents a golden accumulation zone per on-chain maturity metrics.'

Factors Influencing BTC’s Price

Bitcoin Drops Below $115K Amid Leveraged Liquidations, Long-Term Holders Accumulate

Bitcoin's price volatility intensified as it briefly fell below $115,000, with derivatives data pointing to forced liquidations of leveraged positions. The cryptocurrency recovered slightly to trade above $115K, but market structure appears to be shifting beneath the surface.

Binance recorded a 4% drop in open interest within 24 hours, totaling $500 million in position unwinds according to CryptoQuant. Such rapid declines typically signal margin call cascades - a pattern familiar to traders from previous market cycles.

On-chain analytics reveal countervailing pressure from long-term holders accumulating during the dip. This divergence between short-term speculators and patient investors often precedes trend reversals, though timing remains uncertain.

Metaplanet Files $3.7B Shelf Registration to Accelerate Bitcoin Purchases

Japanese digital assets treasury firm Metaplanet has announced a shelf registration to issue up to 555 billion yen ($3.7 billion), signaling aggressive expansion of its Bitcoin strategy. The move follows its recent purchase at an average price of $113,000 per BTC, with analysts speculating a potential rally toward $150,000.

The capital raise positions Metaplanet as one of Asia's most committed corporate bitcoin holders, echoing MicroStrategy's treasury playbook. Market observers note the filing coincides with renewed institutional interest following Bitcoin's post-halving consolidation phase.

24-Hour Crypto Market Update: Trading Volume Surges to $181B Amid BTC Dominance

Crypto markets show resilience as 24-hour trading volume hits $181 billion, with Bitcoin commanding 60% dominance despite a 5.7% pullback in total market capitalization to $3.76 trillion. The activity surge signals renewed investor confidence following recent volatility.

Market dynamics continue to favor BTC as the bellwether asset, with altcoins tracking its movements. The dip in total market value appears corrective rather than structural, with on-chain data suggesting accumulation during price weakness.

Bitcoin Derivatives Data Signals Bearish Sentiment Amid Binance Sell-Off

Bitcoin's sudden drop below $115,000 triggered a wave of panic selling, with Binance at the epicenter. Open interest on the exchange plummeted from $14 billion to $13.5 billion, while net taker volume turned sharply negative at -$160 million—a clear sign of aggressive selling pressure.

The liquidation cascade wiped out $500 million in open interest and forced 183,514 Leveraged traders out of positions within 24 hours. Such moves typically occur when margin calls trigger forced closures, compounding downward momentum.

Derivatives metrics now paint a fearful picture: shrinking open interest, negative taker volume, and $760 million in liquidations across exchanges suggest traders are bracing for further downside. The market's reaction underscores how quickly sentiment can shift in crypto's leveraged ecosystem.

Dormant Bitcoin Wallets from 2010 Move $29.6M, Sparking Market Concerns

Five Bitcoin wallets inactive since 2010 suddenly transferred 250 BTC ($29.6 million) on July 31st. The coins were originally mined in April 2010, during Bitcoin's experimental phase—months before the so-called "Patoshi pattern" (associated with Satoshi Nakamoto's mining activity) disappeared. While early wallet movements aren't unprecedented, traders are wary of potential sell-offs.

Meanwhile, Japan is escalating crypto oversight, transferring regulatory authority to a more powerful financial watchdog. The move aims to curb risks and strengthen investor protections as global scrutiny of digital assets intensifies.

Bitcoin Bull Run Stumbles: Analysts Predict a Possible $111K Retest Soon

Bitcoin's rally has hit a snag below the $120,000 resistance level, with the cryptocurrency trading at $118,000—a 3.6% dip from its recent all-time high. Market participants are weighing the odds of an imminent breakout against the likelihood of a corrective pullback.

On-chain analysts flag a critical "unrealized gap" in Bitcoin's price trajectory. Between July 9-14, BTC surged from $110,000 to $123,000 with minimal trading activity in the $111,000-$117,000 range. CryptoQuant's CryptoMe notes this vacuum was primarily driven by institutional buyers, leaving retail investors on the sidelines. The $111,000-$115,000 zone now looms as a potential retest area before any sustained upward movement.

IMF Recognizes Bitcoin in Global Economic Statistics Overhaul

The International Monetary Fund has formally acknowledged Bitcoin's role in global economic frameworks through a July 31 staff blog post. The update coincides with the UN Statistical Commission's adoption of revised System of National Accounts guidelines, which now classify certain crypto assets as 'non-produced nonfinancial assets.'

This classification places Bitcoin alongside traditional economic assets like land and mineral resources in national wealth accounting. The IMF emphasized this represents measurement protocol rather than valuation, noting Bitcoin's significant energy consumption—comparable to Argentina's annual usage—while remaining excluded from GDP calculations due to its non-traditional economic output.

The decision marks a watershed moment for cryptocurrency institutional recognition. Central banks and treasuries worldwide will now incorporate Bitcoin into balance sheet reporting, reflecting its tangible economic impact despite earlier dismissals by mainstream financial institutions.

Bitcoin’s Declining On-Chain Velocity Signals Maturity, Not Decline

Bitcoin’s on-chain velocity—the rate at which BTC moves between wallets—has plummeted to decade lows, stirring debates about network stagnation. Analysts counter that this trend underscores Bitcoin’s metamorphosis from a transactional medium into a long-term store of value, mirroring digital gold’s trajectory.

Over 70% of Bitcoin supply has remained dormant for more than a year, coinciding with accelerating institutional adoption. U.S. spot Bitcoin ETFs launched in 2024 have funneled nearly 2.55 million BTC—12.8% of circulating supply—into cold storage as corporations like Strategy and Tesla treat it as strategic reserves rather than spendable currency. This behavioral shift depresses transaction frequency while amplifying scarcity.

Traditional velocity metrics fail to capture burgeoning off-chain activity. The Lightning Network’s public capacity has swelled 400% since 2020 to exceed 5,000 BTC, facilitating instant settlements. Meanwhile, Wrapped Bitcoin (WBTC) on Ethereum has seen supply surge 34% in 2025’s first half as DeFi integration deepens.

While reduced velocity squeezes miner revenue post-halving, it cements Bitcoin’s role as macro collateral. The network isn’t fading—it’s graduating.

U.S. Stock Market Loses Over $1 Trillion—Bitcoin Dips Below $130,000

The U.S. stock market shed $1.11 trillion in value as risk aversion swept through financial markets. Bitcoin, often seen as a barometer for crypto sentiment, mirrored the downturn, briefly falling below $130,000 before stabilizing. The sell-off triggered over $1 billion in liquidations across crypto derivatives markets, with both long and short positions caught in the crossfire.

Market watchers noted Bitcoin's sharp decline past $115,000 as traders fled volatile assets. The cascade of liquidations underscores the interconnectedness of traditional and digital asset markets during periods of stress. Analysts are monitoring whether the cryptocurrency can decouple from equities as the situation develops.

Bitcoin Plunges Below $115K Amid Geopolitical Tensions and Market Uncertainty

Bitcoin tumbled below $115,000, hitting $113,164—a multi-week low—as geopolitical tensions escalated following former U.S. President Donald Trump's announcement of nuclear submarine repositioning in response to Russian rhetoric. The sell-off triggered over $200 million in long position liquidations, underscoring heightened market fragility.

Trump's directive came after Dmitry Medvedev, deputy chairman of Russia’s Security Council, criticized his ultimatum for Moscow to end the Ukraine conflict within ten days. "Words are very important and can often lead to unintended consequences," TRUMP cautioned in a Truth Social post, amplifying risk-off sentiment across assets.

The cryptocurrency’s decline coincided with Trump’s broader attacks on U.S. economic institutions, further unsettling investors. Market reactions now hinge on whether nuclear posturing remains rhetorical or escalates into tangible conflict.

Michael Saylor on MicroStrategy's Bitcoin Strategy: 'Everyone Should Own It'

MicroStrategy Executive Chairman Michael Saylor clarified the company's position on Bitcoin accumulation, stating they don't seek to control the supply despite now holding 3% of the total BTC that will ever exist. The business intelligence firm's 214,400 BTC holdings represent a $7.5 billion position acquired through an aggressive treasury strategy.

The company recently expanded its latest preferred stock offering from $500 million to $2.5 billion due to overwhelming demand, marking the largest IPO of the year. MicroStrategy has conducted four IPOs in 2023, deploying all proceeds into Bitcoin purchases. "We'll sell credit instruments like Strike and we'll buy Bitcoin," Saylor explained, outlining their capital allocation strategy.

MicroStrategy employs a multi-tiered investment structure to attract different capital pools. The equity side offers 2x Bitcoin exposure for risk-tolerant investors, while Strike products provide 80% upside participation with principal protection. The newly introduced Stretch product is positioned as "Treasury Bitcoin" for conservative allocators.

Is BTC a good investment?

BTC presents a compelling risk/reward profile at current levels:

| Metric | Value | Implication |

|---|---|---|

| Price/20MA | -3.3% discount | Mean-reversion potential |

| MACD Histogram | +2006.8 | Bullish momentum building |

| Bollinger Position | Lower band test | Oversold conditions |

'DCA strategies outperform here,' advises Ava, 'with 70% of long-term holders increasing positions below $115K.'

HTML table included in text